Military medical retirement pay calculator

Total number of retirement points divided by 360. Eligibility to receive military retirement pay is based on service points earned during service.

Military Retirement Pay Calculator Military Onesource

Military and Retiree Pay Problems Department of Defense DOD Active Duty Reservists.

. Surviving dependents can apply for VA DIC benefits online using VAs website or print and submit Form 21-534 to VA. 20000 for those ages 55 to 64. The app offers a military pay calculator.

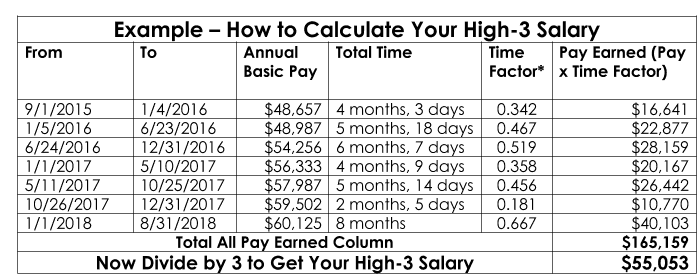

How to use the High-3 military retirement calculator. Retirement Eligibility and Military Credits. Savings Plus Educational Workshops.

Active component military retirement. Visit Military Compensation to find military retirement calculators and to get the latest information on. The Uniformed Services Former Spouses Protection Act USFSPA Title 10 United.

Medical Disability Retirement. A former spouse must have been awarded a portion of a members military retired pay in a State court order. 2022 Reserve Drill Pay chart.

Its available for both iOS and Android. Military Pay and Money. Temporary Disability Retirement List TDRL If you are put on the TDRL you will get retirement benefits including a monthly stipend plus medical coverage for you and your dependents until medical.

Up to 2000 of retirement income. Up to 3500 is exempt Colorado. Military Service before 12311956.

Military Time Buy Back Options - CSRS. 8 1980 and July 31 1986 you can use the High-3 Calculator to figure out your estimated base pay. If you are considering medically retiring and have questions about your combined post military income after medical retirement.

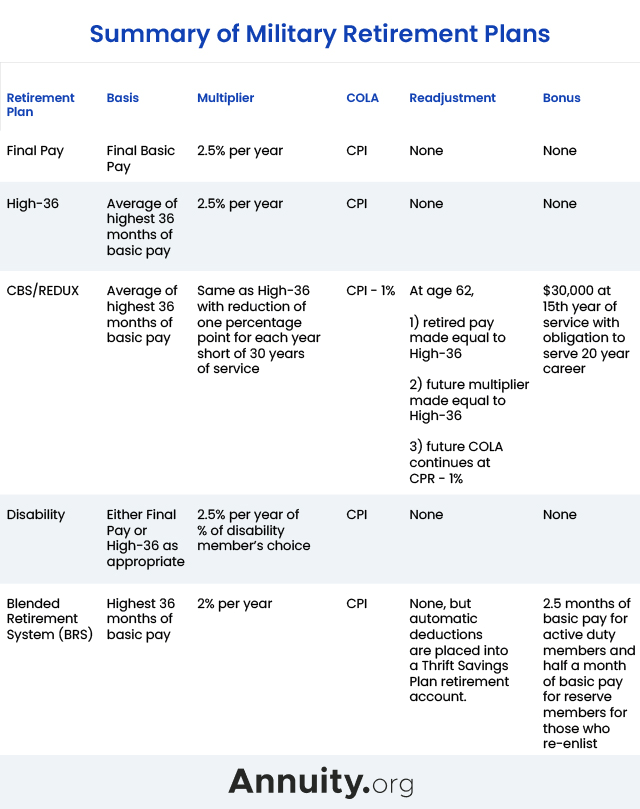

Reserve component military. 2022 Active Duty Basic Pay chart. Three Military Retirement Categories.

It also has other resources to help answer questions related to monthly or annual service pay. Taking a discharge will impact your retired pay. The three basic retirement categories for military members include.

Military Pay Charts and Military Retirement Calculators. Military retirement pay is partially taxed in. Where to file for example is based upon federal law.

Savings Plus for DAA Fairs. Up to 24000 of military retirement pay is exempt for retirees age 65 and older. Those points rely closely on the professional choices a service member makes.

And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Military Service after 111957. For Reserve and Guard service members calculating military retirement pay is an important part of financial and life planning.

A spouse is entitled to one year of transitional medical benefits under the 202015 rule which requires at least twenty years of marriage at least twenty. The Federal Employees Retirement System FERS is a three-tiered system that includes. Permanent disability retirement occurs if the member is found unfit the disability is determined permanent and stable and rated at a minimum of 30 or the member has 20 years of military service For Reserve Component members this means at least 7200 retirement points.

Permanent disability retirement. Equivalent Service Total Creditable Retirement Points 360. If you joined between Sept.

Thrift Savings Plan TSP You are under FERS if. Former Spouses Protection Act. Whether finishing less than 20 years in the active military or starting and ending your career in the Reserves or National Guard the retirement process is a little different than in active duty service qualifying within 20 years of non-interrupted service.

In this instance be sure to include supporting documentation proving you meet the criteria for DIC such as the veterans death certificate to indicate cause of death a marriage. How to Apply for Dependency and Indemnity Compensation. The military retirement system is well documented and understood in general but some mystery surrounds medical disability retirement even among currently serving troops.

This retirement plan offers a pension after 20 years of service that equals 25 of your average basic pay for your three highest-paid years or 36 months for each year you serve. Part-time Seasonal and Temporary Employees PST Savings Plus - 401k 457 Plans. Alternate Retirement Program ARP Contact Savings Plus.

Reserve or national guard members under Title 32 can collect both a federal civil service retirement and a reserve or national guard retirement. As can be seen from these two examples if you initially entered military service on or after 8 September 1980 you should think carefully before requesting a discharge. The question of how and where to divide a military pensionalso known as military retired payis not easy to answer.

Retirement

Military Retirement And Transition Services

Military Compensation Separation Pay 2020

Military Compensation Pay Retirement W3with22years

Military Compensation Pay Retirement E9with30years

Military Retirement And Transition Services

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Military Compensation Pay Retirement E7with20years

Military Compensation Pay Retirement E7with20years

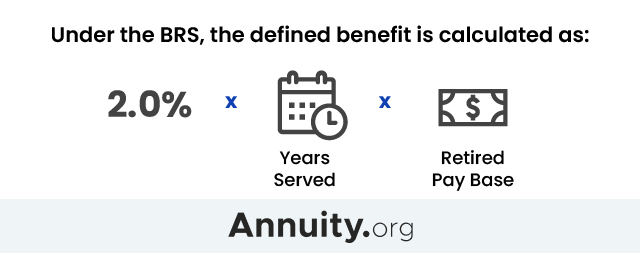

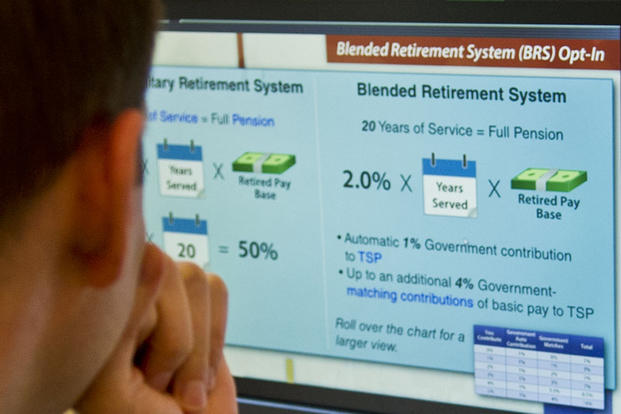

The Blended Retirement System Explained Military Com

E7 Retirement Pay Use The Military Retirement Calculator

E7 Retirement Pay Use The Military Retirement Calculator

Waive Va Compensation For Military Pay Va Form 21 8951

2022 Va Disability Pay Chart And Compensation Rates Cost Of Living Adjustment Cck Law

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Updated For 2022 Va Disability Rates Charts And How To Calculate

E7 Retirement Pay Use The Military Retirement Calculator